At NIIF, corporate governance is not just about legal structures, business controls, checks and balances; it is also about how the business is led and managed. The trust and the confidence that our investors and stakeholders place in us shapes our approach and operations. Guided by our core values, we adhere to robust, best-in-class governance standards with clearly defined roles and responsibilities that ensure accountability.

We receive strategic guidance from our Governing Council, chaired by the Hon’ble Finance Minister of India and composed of eminent leaders from business, investment, and public policy. The Governing Council convenes annually to provide direction on the overall strategy of the NIIF.

Ms. Anuradha Thakur, a senior Indian Administrative Service (IAS) officer of the 1994 batch from the Himachal Pradesh cadre, brings over three decades of administrative expertise in economic affairs, corporate governance, and financial regulation. She currently serves as the Secretary, Department of Economic Affairs and serves as an ex-officio member of both the Reserve Bank of India and the Securities and Exchange Board of India in this capacity.

Her career spans diverse leadership roles across the Government of India. As Additional Secretary in the Ministry of Corporate Affairs, she oversaw corporate governance and regulatory frameworks. She led large corporate fraud investigations during her tenure as Director of the Serious Fraud Investigation Office. As Joint Secretary at the Department of Investment and Public Asset Management, she spearheaded strategic disinvestment initiatives, including the privatization of Air India, and played a pivotal role in launching Bharat Bond ETFs. Internationally, she served as Adviser to the Executive Director at the World Bank, Washington DC.

Ms. Thakur holds a Post-Graduate degree in Psychology. She has further enhanced her expertise through specialized training in Development Economics & Finance at the London School of Economics and Political Science. As a Visiting Fellow with the Centre for Advanced Study for India (CASI) at University of Pennsylvania, she worked on issues related to urban development.

Ms. Thakur has authored and published numerous articles in leading dailies and magazines on water resource management, urban development, social welfare legislation and financial inclusion.

Mr. Amit Singla, an IAS officer from the 2003 batch of the Arunachal Pradesh-Goa-Mizoram and Union Territories (A G M U T) cadre brings over two decades of administrative expertise at the international, national and state level as well as field postings at the district level. He currently serves as the Joint Secretary, Department of Economic Affairs. He holds a graduation and post-graduation in Economics from Punjabi University. He last served as the Adviser to Administrator at the Union Territory of Dadra & Nagar Haveli and Daman & Diu in addition to charges of Home Secretary, Chairman Staff Selection Board and Managing Director, Omnibus Industrial Development Corporation.

As Deputy Secretary, Department of Commerce he contributed to India’s trade policy and economic diplomacy and as Counsellor, Permanent Mission of India to the World Trade Organization (WTO) at Geneva, Switzerland, led India’s engagement in multilateral trade negotiations at WTO.

At the State level, he worked in the Finance Department of Government of Arunachal Pradesh along with handling the job of Excise and VAT (later GST) Commissioner and has served in Education, Health, Home and IT Departments at the state level in various AGMUT segments. He was also a MD & CEO of State Cooperative Banking, Govt. of Arunachal Pradesh.

Mr. Singla was awarded Governors Gold Medal in recognition of meritorious services by Government of Arunachal Pradesh on 26th January, 2009 on the occasion of Republic Day (State Award - Finance). Under his leadership, as Secretary, New Delhi Municipal Council for about 1 year (2020), Delhi was declared as the cleanest capital city amongst all states and UTs in India in Swacch Survekshan 2020 by Government of India. As Deputy Commissioner (DC) of Papumpare district, Arunachal Pradesh, he received the best Deputy Commissioner cum District Project Director Award for Sarva Shikhsha Abhiyaan (SSA) for the year 2006-07 from the State Government (State Award Elementary Education). As DC, North-West Delhi, he was awarded 3rd National prize by Election Commission of India for developing best practices in Delhi (National award – Elections).

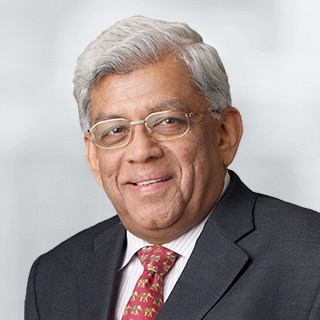

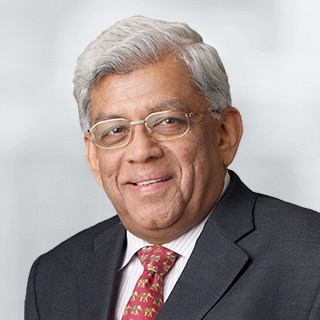

Mr. Deepak Parekh was the Chairman of HDFC Ltd from 1993 to 2023 and was associated with the company for 45 years.

HDFC Ltd was India’s first retail housing finance company that helped turn the dream of owning a home into a reality for millions across the country. Mr. Parekh’s astute business acumen and vision not only made HDFC the leader in mortgages, but also transformed it into India’s leading financial services conglomerate, with a presence in banking, asset management, life insurance, general insurance, property funds, education loans and education.

HDFC Limited merged into HDFC Bank Limited with effect from July 1, 2023. This merger has resulted in HDFC Bank being amongst the top 10 banks globally in terms of market capitalisation.

Mr. Parekh is currently the non-executive chairman of HDFC Asset Management Company Limited, HDFC Capital Services Ltd and Siemens Ltd and is on the board of the National Investment and Infrastructure Fund Ltd. (NIIF).

Mr. Parekh is also on the international board of DP World – UAE, Economic Zones World FZE, UAE, Orient Insurance PJSC (Dubai) and Emirates Investment Bank PJSC (Dubai). He is the Chairman of the Indian advisory board of Accenture and on the international advisory boards of Investcorp International Ltd, Warburg Pincus LLC and Fairbridge Capital Pvt Ltd.

The Mayor of London in 2017 named Deepak Parekh as first of a network of international ambassadors for championing London across the globe.

In addition to being known for his vociferous views seeking standardization and transparency in the real estate sector, Mr. Parekh played a key role as Special Director on the Satyam Board in 2009 to revive the company and a crucial role during the restructuring of UTI in the late ‘90s, which helped regain investors’ confidence.

Mr. Parekh has always been willing to share his ideas and experience to formulate reform policies across sectors. Mr. Parekh has been a member of various high-powered Economic Groups, Advisory Committees and Task Forces which include infrastructure, housing, financial services, capital markets.

A man with a mission, Mr. Parekh’s philosophy on Corporate Social Responsibility is simple yet profound. He believes that if a company earns, it must also return to the society and that companies owe a responsibility not just to shareholders, but also to all its stakeholders. The Government and Industry impressed by Mr. Parekh’s performance and sobriety, have honored him with several awards. Some of the most important ones are; the Padma Bhushan in 2006, ‘Bundesverdienstkreuz’ Germany’s Cross of the Order of Merit one of the highest distinctions by the Federal Republic of Germany in 2014, “Knight in the Order of the Legion of Honour” one of the highest distinctions by the French Republic in 2010, First international recipient of the Outstanding Achievement Award by Institute of Chartered Accountants in England and Wales, in 2010.

Mr. Sanjay Bhandarkar is an investment banker with over 25 years of experience across Rothschild, Peregrine and ICICI Securities focused on corporate finance advisory work. He has been on the board of directors of Tata Power Company Limited, HDFC Asset Management Company Limited and Tata Projects Limited since 2016, October 2018 and March 2021, respectively as an independent non-executive director. In addition, he is also on the board of Chemplast Sanmar Limited as an Independent Director since April 2021. Moreover, he serves as an external member of the investment committee of the South Asia Investment Fund for India.

Mr. Bhandarkar started his career with ICICI and I-Sec, the joint venture between ICICI and JP Morgan, and then spent two years with Peregrine Capital. He was part of the founding team of Rothschild India in 1998 and played a key role in establishing Rothschild as a well-recognised and respected pure play advisory investment banking firm in India. He led the Rothschild business from December 2005 to June 2016 when he decided to step down from his full-time role.

Mr. Bhandarkar’s focus at Rothschild has been on M&A as well as equity capital market advisory business for Indian and international companies. He led the teams that worked closely with the Government of India on the 3G and BWA spectrum auctions, the first e-auctions done in India and on the restructuring of the Enron and GE owned Dabhol power project, one of the largest and most complex restructurings to date.

Mr. Bhandarkar holds an MBA from XLRI, Jamshedpur.

Mr. Debapratim Hajara is currently Managing Director, Infrastructure & Natural Resources at Ontario Teachers' Pension Plan. Prior to that, he had 12 years of experience in infrastructure investing in India and was associated with Macquarie, IDFC and SBI. He also serves as a director on the boards of Mahindra Susten Private Limited, National Highways Infra Investment Managers Private Limited, Sustainable Energy Infra Investment Managers Private Limited, Connexa Limited and Green Energy Infra Project Managers Private Limited.

Mr. Debapratim Hajara holds a MBA in Finance from Xavier Institute of Management, Bhubaneswar and a Masters in Physics from Indian Institute of Technology, Kanpur.

Mr. Martin Adams has served as an independent chairman and director on the boards of over 20 closed end funds and companies, predominantly focused on emerging markets and listed on a European stock exchange. He was nominated to the board of NIIF Limited by AustralianSuper.

Mr. Adams has hands-on experience of managing unquoted investments in a diverse range of countries including India, Vietnam, Brazil, China, Hungary, Poland, Italy, Portugal, Singapore and the UK. He has chaired the boards of London-listed specialist funds holding alternative investments in Indian real estate and infrastructure assets; in private equity investments in cross-border companies that operate in the US-India corridor; and in environmental and emission assets in Asia, Europe and the Americas, including companies active in the reduction of greenhouse gas emissions and associated financial products.

Prior to serving as a director of listed emerging markets funds, Mr. Adams founded Vietnam Fund Management Company, raised and managed the first institutional investment fund for Vietnam and has been involved as a director, manager or sponsor of 11 investment funds and managers in Vietnam. Mr. Adams started his career with the Lloyds Bank group, where he was based in Hong Kong, Portugal, the Netherlands and the UK.

Mr. Adams holds an MA with Honours in Economic Science from the University of Aberdeen.

Mr. Ishaat Hussain served as a Finance Director of Tata Sons Limited and served as its Member of the Group Executive Officers and a Member of Group Corporate Centre till September 2012. He retired from the Board of Tata Sons Ltd in September 2017. Tata Sons Ltd is the holding company of Tata Group which was established in 1868.

Mr. Hussain is an expert in Financial Management & overall Management and Operational Control and has vast experience in the areas of finance, banking, accounts, audit, taxation and general management. He has played a key role in steering the fortunes of companies as diverse as Tata Steel Ltd, Tata Consultancy Services Ltd, Voltas and Titan, as Senior Director on their boards. He has helped nurture many strong alliances in companies such as Tata Sky, Tata AIA Life Insurance and Tata AIG. Besides that, he has been on the Board of many Tata group companies who have been market leaders in their business segment.

Mr. Hussain completed his schooling from the Doon School in 1963 and holds a B.A. (Economics) from St. Stephens College, Delhi and is a Chartered Accountant from England & Wales. He also attended the Advanced Management Program at the Harvard Business School.

Teresa Barger is a Co-Founder and CEO of Cartica Management, LLC. Ms Barger has stepped back from the business in 2023.

In late 2007, Ms. Barger co-founded Cartica Management with two IFC colleagues, Farida Khambata and Mike Lubrano, and one former IFC portfolio company manager, Steven Quamme. Cartica ran an investment strategy for institutional clients focusing on the 24 countries of the Emerging Markets index focusing on long-only, quoted-company investments in small- and mid-cap companies in a concentrated portfolio of 20-25 positions.

Prior to setting up Cartica, Ms. Barger spent 21 years at the International Finance Corporation investing in emerging markets companies in nearly all regions of the world with special emphasis on the Southern Cone of Latin America, Eastern Europe, India, Sub-Saharan Africa, and East Asia. Almost all her investments were in equity with a few debt investments. Many investments required working on the formation of new companies like CRISIL in India, East African Reinsurance in Kenya, and the first leasing company in Turkey. At IFC, among other positions, she was Division Manager for Africa, Deputy Director of Credit/Investment Review, and Director of Private Equity and Investment Funds. In that post she created the first index for EM private equity and co-founded the Emerging Markets Private Equity Association (EMPEA). Ms. Barger also developed the first two corporate governance funds in the Emerging Markets, for Korea and Brazil.

Before joining IFC, Ms. Barger was with McKinsey & Company in New York. She is a member of the Council on Foreign Relations and serves as a Trustee of the American University in Cairo and on the board of Anera.

She serves on the Boards of IX Acquisition Corp and The Egyptian American Enterprise Fund. She is a member of the USAID advisory board and is an advisor to Princeville Climate Tech Fund.

Ms. Barger received her AB magna cum laude from Harvard College and her MBA from the Yale School of Management. She did post-graduate work at the American University in Cairo. She speaks Arabic and French.

She had post-graduate work at the American University in Cairo. She speaks Arabic and French.

Mr. Banmali Agrawala is currently the Senior Advisor at Tata Sons Pvt. Limited, since June 2023. He was earlier with Tata Sons Private Limited, as President, Infrastructure, Defence & Aerospace from October 2017 to June 2023.

In his earlier role, at GE, he was President and CEO - South Asia, where he was responsible for the American multinational corporation’s operations in the South Asia region. Prior to GE, he was Executive Director (Business Development & Strategy) and a member of the Board of Tata Power.

A veteran in the Energy domain, Mr. Agrawala has over 30 years of global experience. He started his career with the Wartsila Group, a Finnish manufacturing and services company, where he spent over 20 years, both in India and in Finland. At the time of leaving the Wartsila Group, he was the Managing Director of Wartsila India Limited, the Global head of the Bio Power Industries and a member of the Global Power Plant Management Board.

In the Tata Group, Mr. Agrawala is currently the Chairman of Tata Advanced Systems Pvt. Limited and its subsidiaries – Tata Boing Aerospace Limited, Tata Lockheed Martin Aerospace Limited, Tata Sikorsky Aerospace Limited. He is also a Board Director of Tata Electronics Pvt. Limited and Tata Medical & Diagnostics Limited.

Outside of the Tata Group, he is a member of the Board of Directors of KONE Corporation, Finland and Pratham Education Foundation, a Not For Profit organisation in India. Mr. Agrawala is a Mechanical Engineering graduate from Mangalore University and an alumnus of the Advanced Management Programme of Harvard Business School.

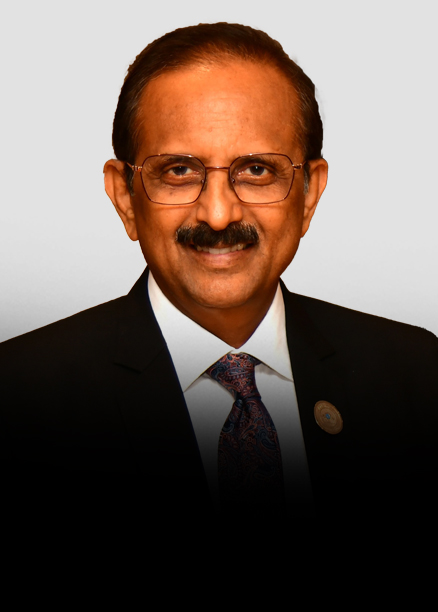

Bringing over 35 years of expertise, Mr. Aggarwal has deep experience in the infrastructure and energy sectors with a proven track record of fostering sustainable growth and investment.

Before his appointment as CEO & MD of NIIF Limited in February 2024, Mr Aggarwal worked with Actis, a leading global investor in sustainable infrastructure, where he joined in 2008, and became a partner in 2010. He led Actis’ energy business in Asia and established Actis as a leading foreign investor in Indian renewables. He also started Actis’ energy investing business in South East Asia and Japan.

Prior to his tenure at Actis, Mr. Aggarwal worked with Citigroup and ANZ Investment Bank in the Indian energy and infrastructure sectors. This background has equipped him with a deep understanding of the challenges and opportunities within these critical industries.

Mr. Aggarwal has a B. Tech (Hons) in Mining Engineering and a distinguished alumnus award from IIT (ISM) Dhanbad (formerly Indian School of Mines, Dhanbad), as well as a PGDBM from XLRI Jamshedpur.

Ms. Anuradha Thakur, a senior Indian Administrative Service (IAS) officer of the 1994 batch from the Himachal Pradesh cadre, brings over three decades of administrative expertise in economic affairs, corporate governance, and financial regulation. She currently serves as the Secretary, Department of Economic Affairs and serves as an ex-officio member of both the Reserve Bank of India and the Securities and Exchange Board of India in this capacity.

Her career spans diverse leadership roles across the Government of India. As Additional Secretary in the Ministry of Corporate Affairs, she oversaw corporate governance and regulatory frameworks. She led large corporate fraud investigations during her tenure as Director of the Serious Fraud Investigation Office. As Joint Secretary at the Department of Investment and Public Asset Management, she spearheaded strategic disinvestment initiatives, including the privatization of Air India, and played a pivotal role in launching Bharat Bond ETFs. Internationally, she served as Adviser to the Executive Director at the World Bank, Washington DC.

Ms. Thakur holds a Post-Graduate degree in Psychology. She has further enhanced her expertise through specialized training in Development Economics & Finance at the London School of Economics and Political Science. As a Visiting Fellow with the Centre for Advanced Study for India (CASI) at University of Pennsylvania, she worked on issues related to urban development.

Ms. Thakur has authored and published numerous articles in leading dailies and magazines on water resource management, urban development, social welfare legislation and financial inclusion.

Mr. Amit Singla, an IAS officer from the 2003 batch of the Arunachal Pradesh-Goa-Mizoram and Union Territories (A G M U T) cadre brings over two decades of administrative expertise at the international, national and state level as well as field postings at the district level. He currently serves as the Joint Secretary, Department of Economic Affairs. He holds a graduation and post-graduation in Economics from Punjabi University. He last served as the Adviser to Administrator at the Union Territory of Dadra & Nagar Haveli and Daman & Diu in addition to charges of Home Secretary, Chairman Staff Selection Board and Managing Director, Omnibus Industrial Development Corporation.

As Deputy Secretary, Department of Commerce he contributed to India’s trade policy and economic diplomacy and as Counsellor, Permanent Mission of India to the World Trade Organization (WTO) at Geneva, Switzerland, led India’s engagement in multilateral trade negotiations at WTO.

At the State level, he worked in the Finance Department of Government of Arunachal Pradesh along with handling the job of Excise and VAT (later GST) Commissioner and has served in Education, Health, Home and IT Departments at the state level in various AGMUT segments. He was also a MD & CEO of State Cooperative Banking, Govt. of Arunachal Pradesh.

Mr. Singla was awarded Governors Gold Medal in recognition of meritorious services by Government of Arunachal Pradesh on 26th January, 2009 on the occasion of Republic Day (State Award - Finance). Under his leadership, as Secretary, New Delhi Municipal Council for about 1 year (2020), Delhi was declared as the cleanest capital city amongst all states and UTs in India in Swacch Survekshan 2020 by Government of India. As Deputy Commissioner (DC) of Papumpare district, Arunachal Pradesh, he received the best Deputy Commissioner cum District Project Director Award for Sarva Shikhsha Abhiyaan (SSA) for the year 2006-07 from the State Government (State Award Elementary Education). As DC, North-West Delhi, he was awarded 3rd National prize by Election Commission of India for developing best practices in Delhi (National award – Elections).

Mr. Deepak Parekh was the Chairman of HDFC Ltd from 1993 to 2023 and was associated with the company for 45 years.

HDFC Ltd was India’s first retail housing finance company that helped turn the dream of owning a home into a reality for millions across the country. Mr. Parekh’s astute business acumen and vision not only made HDFC the leader in mortgages, but also transformed it into India’s leading financial services conglomerate, with a presence in banking, asset management, life insurance, general insurance, property funds, education loans and education.

HDFC Limited merged into HDFC Bank Limited with effect from July 1, 2023. This merger has resulted in HDFC Bank being amongst the top 10 banks globally in terms of market capitalisation.

Mr. Parekh is currently the non-executive chairman of HDFC Asset Management Company Limited, HDFC Capital Services Ltd and Siemens Ltd and is on the board of the National Investment and Infrastructure Fund Ltd. (NIIF).

Mr. Parekh is also on the international board of DP World – UAE, Economic Zones World FZE, UAE, Orient Insurance PJSC (Dubai) and Emirates Investment Bank PJSC (Dubai). He is the Chairman of the Indian advisory board of Accenture and on the international advisory boards of Investcorp International Ltd, Warburg Pincus LLC and Fairbridge Capital Pvt Ltd.

The Mayor of London in 2017 named Deepak Parekh as first of a network of international ambassadors for championing London across the globe.

In addition to being known for his vociferous views seeking standardization and transparency in the real estate sector, Mr. Parekh played a key role as Special Director on the Satyam Board in 2009 to revive the company and a crucial role during the restructuring of UTI in the late ‘90s, which helped regain investors’ confidence.

Mr. Parekh has always been willing to share his ideas and experience to formulate reform policies across sectors. Mr. Parekh has been a member of various high-powered Economic Groups, Advisory Committees and Task Forces which include infrastructure, housing, financial services, capital markets.

A man with a mission, Mr. Parekh’s philosophy on Corporate Social Responsibility is simple yet profound. He believes that if a company earns, it must also return to the society and that companies owe a responsibility not just to shareholders, but also to all its stakeholders. The Government and Industry impressed by Mr. Parekh’s performance and sobriety, have honored him with several awards. Some of the most important ones are; the Padma Bhushan in 2006, ‘Bundesverdienstkreuz’ Germany’s Cross of the Order of Merit one of the highest distinctions by the Federal Republic of Germany in 2014, “Knight in the Order of the Legion of Honour” one of the highest distinctions by the French Republic in 2010, First international recipient of the Outstanding Achievement Award by Institute of Chartered Accountants in England and Wales, in 2010.

Mr. Sanjay Bhandarkar is an investment banker with over 25 years of experience across Rothschild, Peregrine and ICICI Securities focused on corporate finance advisory work. He has been on the board of directors of Tata Power Company Limited, HDFC Asset Management Company Limited and Tata Projects Limited since 2016, October 2018 and March 2021, respectively as an independent non-executive director. In addition, he is also on the board of Chemplast Sanmar Limited as an Independent Director since April 2021. Moreover, he serves as an external member of the investment committee of the South Asia Investment Fund for India.

Mr. Bhandarkar started his career with ICICI and I-Sec, the joint venture between ICICI and JP Morgan, and then spent two years with Peregrine Capital. He was part of the founding team of Rothschild India in 1998 and played a key role in establishing Rothschild as a well-recognised and respected pure play advisory investment banking firm in India. He led the Rothschild business from December 2005 to June 2016 when he decided to step down from his full-time role.

Mr. Bhandarkar’s focus at Rothschild has been on M&A as well as equity capital market advisory business for Indian and international companies. He led the teams that worked closely with the Government of India on the 3G and BWA spectrum auctions, the first e-auctions done in India and on the restructuring of the Enron and GE owned Dabhol power project, one of the largest and most complex restructurings to date.

Mr. Bhandarkar holds an MBA from XLRI, Jamshedpur.

Mr. Debapratim Hajara is currently Managing Director, Infrastructure & Natural Resources at Ontario Teachers' Pension Plan. Prior to that, he had 12 years of experience in infrastructure investing in India and was associated with Macquarie, IDFC and SBI. He also serves as a director on the boards of Mahindra Susten Private Limited, National Highways Infra Investment Managers Private Limited, Sustainable Energy Infra Investment Managers Private Limited, Connexa Limited and Green Energy Infra Project Managers Private Limited.

Mr. Debapratim Hajara holds a MBA in Finance from Xavier Institute of Management, Bhubaneswar and a Masters in Physics from Indian Institute of Technology, Kanpur.

Mr. Martin Adams has served as an independent chairman and director on the boards of over 20 closed end funds and companies, predominantly focused on emerging markets and listed on a European stock exchange. He was nominated to the board of NIIF Limited by AustralianSuper.

Mr. Adams has hands-on experience of managing unquoted investments in a diverse range of countries including India, Vietnam, Brazil, China, Hungary, Poland, Italy, Portugal, Singapore and the UK. He has chaired the boards of London-listed specialist funds holding alternative investments in Indian real estate and infrastructure assets; in private equity investments in cross-border companies that operate in the US-India corridor; and in environmental and emission assets in Asia, Europe and the Americas, including companies active in the reduction of greenhouse gas emissions and associated financial products.

Prior to serving as a director of listed emerging markets funds, Mr. Adams founded Vietnam Fund Management Company, raised and managed the first institutional investment fund for Vietnam and has been involved as a director, manager or sponsor of 11 investment funds and managers in Vietnam. Mr. Adams started his career with the Lloyds Bank group, where he was based in Hong Kong, Portugal, the Netherlands and the UK.

Mr. Adams holds an MA with Honours in Economic Science from the University of Aberdeen.

Mr. Ishaat Hussain served as a Finance Director of Tata Sons Limited and served as its Member of the Group Executive Officers and a Member of Group Corporate Centre till September 2012. He retired from the Board of Tata Sons Ltd in September 2017. Tata Sons Ltd is the holding company of Tata Group which was established in 1868.

Mr. Hussain is an expert in Financial Management & overall Management and Operational Control and has vast experience in the areas of finance, banking, accounts, audit, taxation and general management. He has played a key role in steering the fortunes of companies as diverse as Tata Steel Ltd, Tata Consultancy Services Ltd, Voltas and Titan, as Senior Director on their boards. He has helped nurture many strong alliances in companies such as Tata Sky, Tata AIA Life Insurance and Tata AIG. Besides that, he has been on the Board of many Tata group companies who have been market leaders in their business segment.

Mr. Hussain completed his schooling from the Doon School in 1963 and holds a B.A. (Economics) from St. Stephens College, Delhi and is a Chartered Accountant from England & Wales. He also attended the Advanced Management Program at the Harvard Business School.

Teresa Barger is a Co-Founder and CEO of Cartica Management, LLC. Ms Barger has stepped back from the business in 2023.

In late 2007, Ms. Barger co-founded Cartica Management with two IFC colleagues, Farida Khambata and Mike Lubrano, and one former IFC portfolio company manager, Steven Quamme. Cartica ran an investment strategy for institutional clients focusing on the 24 countries of the Emerging Markets index focusing on long-only, quoted-company investments in small- and mid-cap companies in a concentrated portfolio of 20-25 positions.

Prior to setting up Cartica, Ms. Barger spent 21 years at the International Finance Corporation investing in emerging markets companies in nearly all regions of the world with special emphasis on the Southern Cone of Latin America, Eastern Europe, India, Sub-Saharan Africa, and East Asia. Almost all her investments were in equity with a few debt investments. Many investments required working on the formation of new companies like CRISIL in India, East African Reinsurance in Kenya, and the first leasing company in Turkey. At IFC, among other positions, she was Division Manager for Africa, Deputy Director of Credit/Investment Review, and Director of Private Equity and Investment Funds. In that post she created the first index for EM private equity and co-founded the Emerging Markets Private Equity Association (EMPEA). Ms. Barger also developed the first two corporate governance funds in the Emerging Markets, for Korea and Brazil.

Before joining IFC, Ms. Barger was with McKinsey & Company in New York. She is a member of the Council on Foreign Relations and serves as a Trustee of the American University in Cairo and on the board of Anera.

She serves on the Boards of IX Acquisition Corp and The Egyptian American Enterprise Fund. She is a member of the USAID advisory board and is an advisor to Princeville Climate Tech Fund.

Ms. Barger received her AB magna cum laude from Harvard College and her MBA from the Yale School of Management. She did post-graduate work at the American University in Cairo. She speaks Arabic and French.

She had post-graduate work at the American University in Cairo. She speaks Arabic and French.

Mr. Banmali Agrawala is currently the Senior Advisor at Tata Sons Pvt. Limited, since June 2023. He was earlier with Tata Sons Private Limited, as President, Infrastructure, Defence & Aerospace from October 2017 to June 2023.

In his earlier role, at GE, he was President and CEO - South Asia, where he was responsible for the American multinational corporation’s operations in the South Asia region. Prior to GE, he was Executive Director (Business Development & Strategy) and a member of the Board of Tata Power.

A veteran in the Energy domain, Mr. Agrawala has over 30 years of global experience. He started his career with the Wartsila Group, a Finnish manufacturing and services company, where he spent over 20 years, both in India and in Finland. At the time of leaving the Wartsila Group, he was the Managing Director of Wartsila India Limited, the Global head of the Bio Power Industries and a member of the Global Power Plant Management Board.

In the Tata Group, Mr. Agrawala is currently the Chairman of Tata Advanced Systems Pvt. Limited and its subsidiaries – Tata Boing Aerospace Limited, Tata Lockheed Martin Aerospace Limited, Tata Sikorsky Aerospace Limited. He is also a Board Director of Tata Electronics Pvt. Limited and Tata Medical & Diagnostics Limited.

Outside of the Tata Group, he is a member of the Board of Directors of KONE Corporation, Finland and Pratham Education Foundation, a Not For Profit organisation in India. Mr. Agrawala is a Mechanical Engineering graduate from Mangalore University and an alumnus of the Advanced Management Programme of Harvard Business School.

Bringing over 35 years of expertise, Mr. Aggarwal has deep experience in the infrastructure and energy sectors with a proven track record of fostering sustainable growth and investment.

Before his appointment as CEO & MD of NIIF Limited in February 2024, Mr Aggarwal worked with Actis, a leading global investor in sustainable infrastructure, where he joined in 2008, and became a partner in 2010. He led Actis’ energy business in Asia and established Actis as a leading foreign investor in Indian renewables. He also started Actis’ energy investing business in South East Asia and Japan.

Prior to his tenure at Actis, Mr. Aggarwal worked with Citigroup and ANZ Investment Bank in the Indian energy and infrastructure sectors. This background has equipped him with a deep understanding of the challenges and opportunities within these critical industries.

Mr. Aggarwal has a B. Tech (Hons) in Mining Engineering and a distinguished alumnus award from IIT (ISM) Dhanbad (formerly Indian School of Mines, Dhanbad), as well as a PGDBM from XLRI Jamshedpur.

The Investment Committee (IC) is a key pillar of NIIF’s governance structure. It is responsible for all investments & divestment decisions and reviews investment performance regularly. The IC comprises senior management team members from NIIF, including the Managing Director & CEO and the Chief Investment Officer (CIO).

Every business decision we make aligns with our purpose to benefit stakeholders by assessing inherent risks and opportunities. Our focus on responsible investing ensures that our funds and portfolio companies adhere to best practices, driving sustainable value creation and positive impact.

Empowerment is at the heart of our culture. We provide an inclusive, supportive and stimulating work environment that enables talent to flourish.

Learn More

Learn More