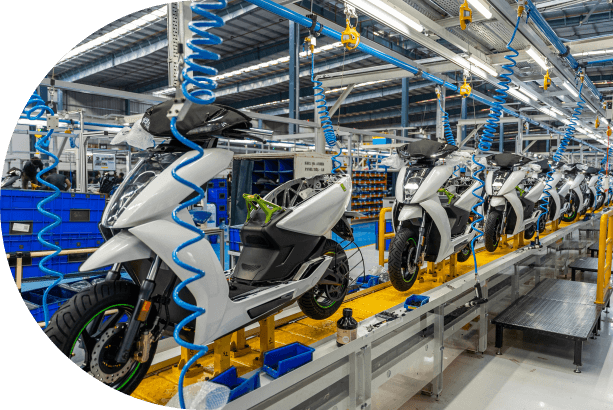

Ather

Energy

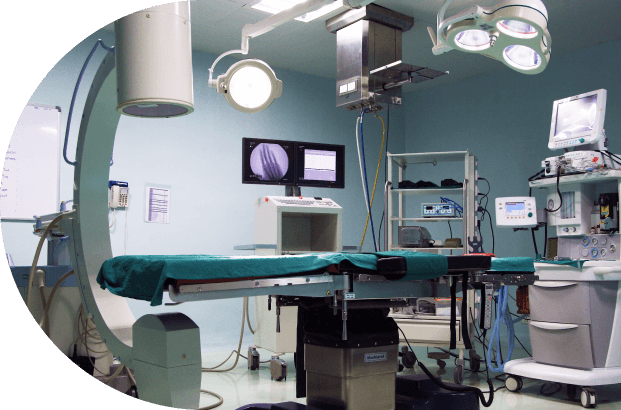

Profits generated from Manipal Hospitals exit, one of the largest minority exits in India

Capital invested

Loanbook of NBFC platforms, one of the leading infrastructure NBFCs in India

NIIF’s Strategic Opportunities Fund (SOF) is an India-focused growth equity fund. Established with the objective of providing long-term capital to high-growth future-ready businesses in India, the fund’s strategy is to build a portfolio of large entrepreneur-led or professionally managed domestic champions and unicorns.

Through its direct growth equity strategy, NIIF aims to invest in sectors that benefit from the changing business landscape in India as well as demonstrating intrinsic structural growth; excluding commoditised sectors, sectors lacking ESG orientation, and core infrastructure. Segmental leadership or leadership potential along with sound corporate governance standards are important filters for portfolio company selection within target sectors.

The fund invests through both active minority stakes and control-oriented/incubation deals. When investing in minority positions, NIIF seeks to partner with entrepreneurs with a strong track record of value creation, robust governance standards and a collaborative mindset. In control-oriented deals, NIIF aspires to invest in businesses managed by best-in-class management teams.

NIIF has invested across sectors including:

vision

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

vision2

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

vision3

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

vision4

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

vision5

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

vision6

Build a professionally managed pan-India portfolio of road assets.

strategy & APPROACH

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards. Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

NIIF’s Strategic Opportunities Fund (SOF) is a classic growth equity fund managed by an investment team with extensive investing experience across several cycles. The team leverages NIIF’s networks and scale in India, and its strong governance frameworks, targeting significant value creation.

NIIF aims to create domestic champions, with large-ticket growth capital and through the institutionalisation of business leadership, financial discipline, and operational excellence. For investors, the positioning of portfolio companies as segment leaders provides multiple options for exit at premium valuations.

Through its direct growth equity strategy, NIIF aims to invest in sectors that benefit from the changing business landscape in India as well as demonstrating intrinsic structural growth; excluding commoditised sectors, sectors lacking ESG orientation, and core infrastructure. Segmental leadership or leadership potential along with sound corporate governance standards are important filters for portfolio company selection within target sectors.

The fund invests through both active minority stakes and control-oriented/incubation deals. When investing in minority positions, NIIF seeks to partner with entrepreneurs with a strong track record of value creation, robust governance standards and a collaborative mindset. In control-oriented deals, NIIF aspires to invest in businesses managed by best-in-class management teams.

NIIF has invested across sectors including:

Build a professionally managed pan-India portfolio of road assets.

As part of its vision to transition to a more sustainable economy, the Government of India has committed to a 450 GW renewables capacity by 2030. This would mean quintupling our existing capacity and would require implementation at scale. Our investment in Ayana is envisaged to make a meaningful contribution to this energy transformation by developing and managing utility-scale renewable power projects across India.

We envision Ayana to expand into sustainable energy adjacencies such as battery storage, green hydrogen etc. to provide comprehensive energy supply solutions to buyers.

We have partnered with other likeminded investors, CDC and EverSource on the Ayana investment.

End-to-end integrated multimodal logistics service provider of choice for customers across India fulling their EXIM and domestic logistics requirements at the lowest cost.

India’s logistics cost (as a percent of the GDP) continues to remain high amongst the major global economies with a highly fragmented and an inefficient supply chain. With the Government of India working towards making India a $5tn economy by 2025 – it is imperative to have a strong logistics value chain to serve the rapidly growing demand with a focus on improving the ease-of-doing-business in India.

Under HIPL, we seek to capture this growth by developing a pan-India network of high-quality logistics infrastructure assets overlaid with a strong digital backbone to provide a seamless solution to end-customers. HIPL offers a strong proposition to customers through diversified offerings across multiple modes (rail, road, riverine, air) and commodities (containers, bulk, etc) with various solutions (inland container depots, private freight terminals, free-trade warehousing zones, warehousing, express, and contract logistics, ports, and terminals).

DP World, our joint venture partner in HIPL, is amongst the largest container terminal operators globally and the largest player (by volume) in the Indian container market.

Build a professionally managed pan-India portfolio of road assets.

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards.

Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

NIIF’s Strategic Opportunities Fund (SOF) is a classic growth equity fund managed by an investment team with extensive investing experience across several cycles. The team leverages NIIF’s networks and scale in India, and its strong governance frameworks, targeting significant value creation.

NIIF aims to create domestic champions, with large-ticket growth capital and through the institutionalisation of business leadership, financial discipline, and operational excellence. For investors, the positioning of portfolio companies as segment leaders provides multiple options for exit at premium valuations.

National Investment and Infrastructure Fund II is a Category II Alternative Investment Fund registered with Securities and Exchange Board of India (Reg No.: IN/AIF2/17-18/0526), referred to throughout this website as “NIIF Strategic Opportunities Fund”. Mr. Nilesh Shrivastava is the Fund Manager.

Learn More

Learn More