India’s largest infrastructure fund investing in high-quality businesses across core sectors. Established to capitalise on India’s projected USD 1.5 trillion infrastructure growth over the next decade. We offer global investors access to India’s market through top-tier fund managers and co-investment opportunities.

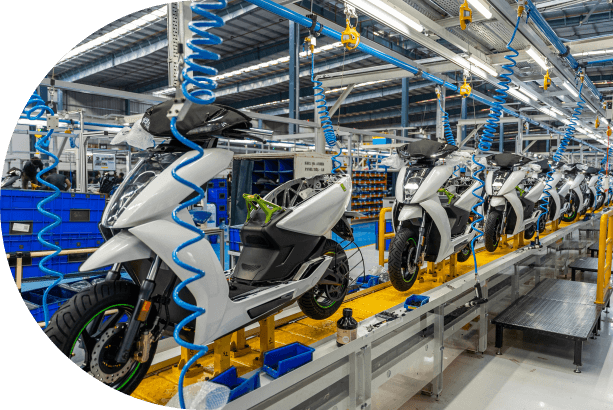

High-Impact Investments in

Electric Mobility

Fund size

Commitment from Japan Bank for International Cooperation & Government of India

The India-Japan Fund (IJF) is a strategic bilateral partnership between the Government of India (“GoI”) and Japan Bank for International Cooperation (“JBIC”), a Japanese public financial institution, both being anchor investors in the Fund. The Fund seeks to invest in India’s environment preservation sector and also to explore opportunities to partner with Japanese companies investing into India.

The Fund aims to invest in sectors that focus on environmental preservation. This includes investing in green sectors and traditionally high GHG emitting sectors which are proactively focusing on a low carbon emission strategy. Given that the theme cuts across sectors, IJF has a sector-agnostic strategy.

Given the strategic partnership with JBIC, IJF also intends to promote business collaboration between Japanese companies and Indian companies, including investing along with Japanese companies into India. This could be in the form of helping Japanese companies set up base in India, helping them execute strategic partnerships with Indian companies, and co-investing with Japanese companies into Indian companies across sectors.

In order to further expand the Fund’s footprint into its target focus areas, IJF could also strategically invest in mid-sized climate-focussed / low carbon emission funds – this would enable IJF to indirectly participate in a larger set of opportunities and thus help further catalyse capital into this segment.

vision

Build a professionally managed pan-India portfolio of road assets.

Strategy and Approach

As part of its vision to transition to a more sustainable economy, the Government of India has committed to a 450 GW renewables capacity by 2030. This would mean quintupling our existing capacity and would require implementation at scale. Our investment in Ayana is envisaged to make a meaningful contribution to this energy transformation by developing and managing utility-scale renewable power projects across India.

We envision Ayana to expand into sustainable energy adjacencies such as battery storage, green hydrogen etc. to provide comprehensive energy supply solutions to buyers.

Partnerships

We have partnered with other likeminded investors, CDC and EverSource on the Ayana investment.

Vision

End-to-end integrated multimodal logistics service provider of choice for customers across India fulling their EXIM and domestic logistics requirements at the lowest cost.

Strategy and Approach

India’s logistics cost (as a percent of the GDP) continues to remain high amongst the major global economies with a highly fragmented and an inefficient supply chain. With the Government of India working towards making India a $5tn economy by 2025 – it is imperative to have a strong logistics value chain to serve the rapidly growing demand with a focus on improving the ease-of-doing-business in India.

Under HIPL, we seek to capture this growth by developing a pan-India network of high-quality logistics infrastructure assets overlaid with a strong digital backbone to provide a seamless solution to end-customers. HIPL offers a strong proposition to customers through diversified offerings across multiple modes (rail, road, riverine, air) and commodities (containers, bulk, etc) with various solutions (inland container depots, private freight terminals, free-trade warehousing zones, warehousing, express, and contract logistics, ports, and terminals).

Partnership

DP World, our joint venture partner in HIPL, is amongst the largest container terminal operators globally and the largest player (by volume) in the Indian container market.

Vision

Build a professionally managed pan-India portfolio of road assets.

Strategy and Approach

India has the second largest road network globally. Road sector is the foundation of a country’s economy and hence the Government’s continued focus on development of public-private partnership for building & improving the country’s road network. Through Athaang, our proprietary roads platform, we are well-poised to lead this industry growth leveraging our management’s sectoral expertise, proven in-house operation & maintenance capabilities, technologically led efficient processes and ethically conscious governance standards.

Having already acquired two strategic operational toll road assets in the southern part of the country, Athaang shall continue to deliver on its disciplined M&A and post-takeover asset turnaround strategy building a diversified portfolio of toll, annuity & HAM assets requiring both greenfield & brownfield expansion.

Vision

To strengthen air travel penetration and connectivity, especially to Tier 2 and Tier 3 cities.

Strategy and Approach

The aviation industry in India has emerged as one of the fastest growing industries in the country during the last three years. A rising proportion of middle-income households, healthy competition amongst Low-Cost Carriers, infrastructure buildup at leading airports and supportive policy framework has given a fillip to the aviation sector. To meet the growing demand for air travel in India, it has become imperative to increase the capacity of airport infrastructure.

NIIF aims to provide vital infrastructure to deliver a world-class passenger experience while significantly enhancing air travel potential. NIIF’s investments in Manohar International Airport in Goa and Bhogapuram International Airport in Andhra Pradesh project aim to boost connectivity and transportation infrastructure and also resonates with national priorities of strengthening air travel penetration and connectivity, especially to Tier 2 and Tier 3 cities.

Partnerships

NIIF has partnered with GMR Airports Limited (GAL), the airport business holding entity and a subsidiary of GMR Airports Infrastructure Limited, to invest in the equity capital of three airport projects.

Vision

Create an efficient energy ecosystem, generate value by reducing inefficiencies and energy losses in the power value chain and be a distinct market leader in the smart metering space.

Strategy and Approach

Indian power sector is witnessing rapid transformation with significant focus being laid on transforming the power distribution sector – the most critical component of the value chain which has been reeling under huge debt and record losses. While Government of India is outlining various initiatives to transform the power sector, we believe roll-out of smart meter infrastructure will play a transformational role in bringing efficiencies.

Smart meters will generate commercial benefits for power distribution companies and empower consumers to make informed choices regarding power consumption. Government has announced plans to install 250 million smart meters across India in the next few years. Intellismart is amongst the first few companies established to focus dedicatedly on smart meter infrastructure and it is well positioned to give a fillip to India’s smart grid vision. Intellismart will operate under the BOOT model and provide single-stop solutions to distribution companies for all their smart meter requirements. Overtime, Intellismart will evolve into a digital-services player supporting the power sector by harnessing the data collected through smart meter deployment.

Partnerships

We have partnered with EESL to create IntelliSmart. EESL, a Government of India enterprise, is the world’s largest public energy service company (ESCO) engaged across range of initiatives that has helped India save over 47 billion kWh energy annually.

Vision

To create digital infrastructure that can facilitateIndia’s rapid transformation into a digitally empowered society and a global knowledge economy.

The digital landscape in India is evolving at an unprecedented pace, with the digital transformation unlocking immense potential and promise for the nation. A robust backend infrastructure is required to support this digital transformation and about USD35-USD40 billion in capital expenditure is expected in the sector in the next five years, creating a need for substantial investments in the space.

NIIF’s investments in this space align with the Digital India Mission initiated by the Government of India, aimed at transforming the country into a digitally empowered society and a global knowledge economy. NIIF’s investment in iBus strengthens its position as a leader in In-building solutions, outdoor small cells and managed WiFi services while expanding its presence in new emerging sectors (such as IoT solutions). NIIF is also setting up a 300MW data centre near Mumbai, the largest single-site data centre in APAC..

Partnerships

NIIF has partnered with Digital Edge (Singapore) Holdings Pte. Ltd.and AGP DC InvestCo Pte Ltd to develop a pan-India portfolio of hyperscale data centres.

IJF has appointed JBIC IG Partners (JBIC IG), JBIC’s investment management arm, as a service provider to the Fund. JBIC IG has experience in fund management across Asia and Europe. Given its global presence, JBIC IG will be able to bring in global perspective and recommend best practices for investment evaluation and portfolio monitoring.

IJF leverages the extensive experience of its partners across the public and private sectors in investing, operations, and financial expertise.

The Fund aims to invest in sectors that focus on environmental preservation. This includes investing in green sectors and traditionally high GHG emitting sectors which are proactively focusing on a low carbon emission strategy. Given that the theme cuts across sectors, IJF has a sector-agnostic strategy.

Given the strategic partnership with JBIC, IJF also intends to promote business collaboration between Japanese companies and Indian companies, including investing along with Japanese companies into India. This could be in the form of helping Japanese companies set up base in India, helping them execute strategic partnerships with Indian companies, and co-investing with Japanese companies into Indian companies across sectors.

In order to further expand the Fund’s footprint into its target focus areas, IJF could also strategically invest in mid-sized climate-focussed / low carbon emission funds – this would enable IJF to indirectly participate in a larger set of opportunities and thus help further catalyse capital into this segment.

IJF has appointed JBIC IG Partners (JBIC IG), JBIC’s investment management arm, as a service provider to the Fund. JBIC IG has experience in fund management across Asia and Europe. Given its global presence, JBIC IG will be able to bring in global perspective and recommend best practices for investment evaluation and portfolio monitoring.

IJF leverages the extensive experience of its partners across the public and private sectors in investing, operations, and financial expertise.

India-Japan Fund is a Category I| Alternative Investment Fund registered with Securities and Exchange Board of India (Reg No.: IN/AIF2/23-24/1324). Mr. Krishna Kumar is the Fund Manager.

Learn More

Learn More