Anchored by the Government of India, we raise a majority of our capital from global and domestic institutional investors across all our funds

We are a holistic provider of solutions to our LPs and Indian companies through equity and structured debt

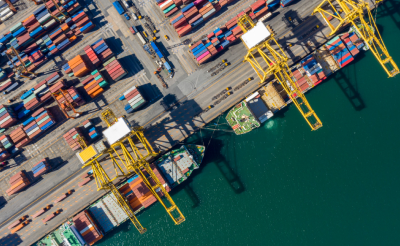

We have the ability to take construction risk as builders and operators

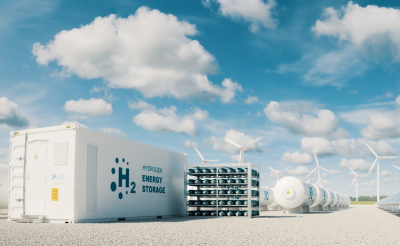

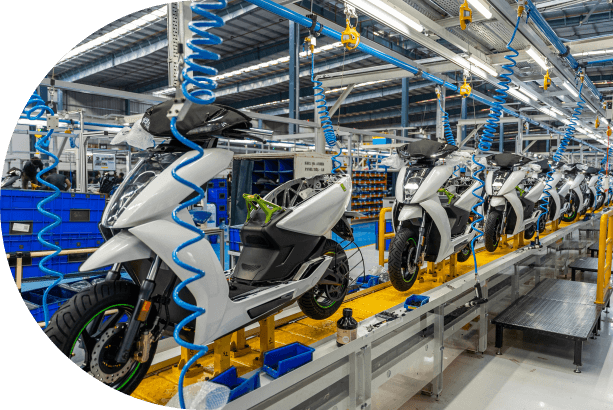

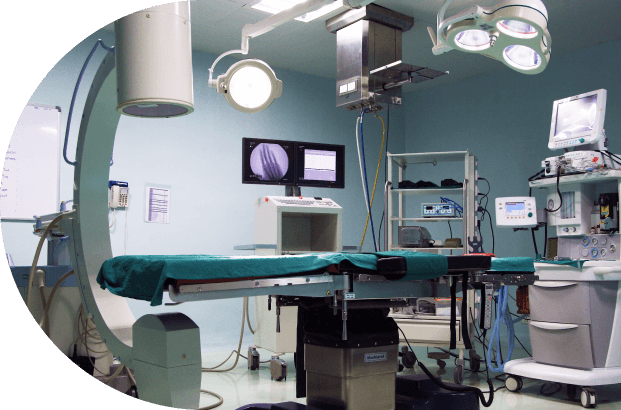

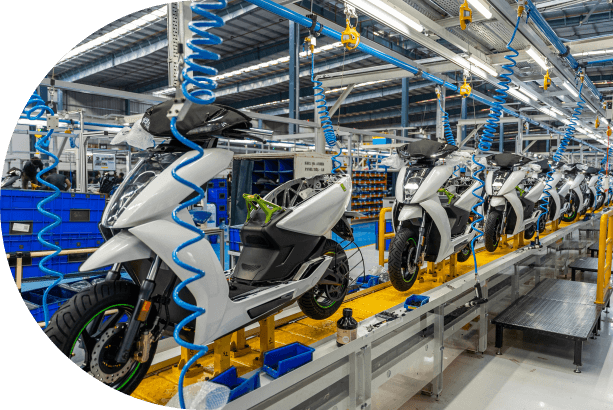

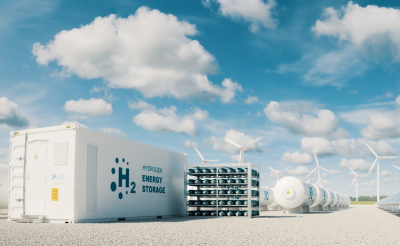

We provide growth capital at scale to sunrise sectors

We are a provider of holistic solutions to our Limited Partners (LPs) and Indian companies through equity and structured debt

We have the ability to take construction risk as builders & operators

We provide growth capital at scale to sunrise sectors

Strategic advisory for national investment and policy priorities across infrastructure and emerging growth sectors

Strategic advisory for national investment and policy priorities across infrastructure and emerging growth sectors

In February 2025, NIIF signed a Share Purchase Agreement (SPA) with ONGC NTPC Green Private Limited (ONGPL) to exit its investment in Ayana Renewable Power Private Limited. The transaction, with an enterprise value of INR 195 billion (USD 2.3 billion), sees ONGPL acquire a 100% equity stake in Ayana.

HIPL also has a pan-India presence through coldchain and express logistics facilities

Every business decision we make aligns with our purpose to benefit stakeholders by assessing inherent risks and opportunities. Our focus on responsible investing ensures that our funds and portfolio companies adhere to best practices, driving sustainable value creation and positive impact.

Learn More

Learn More