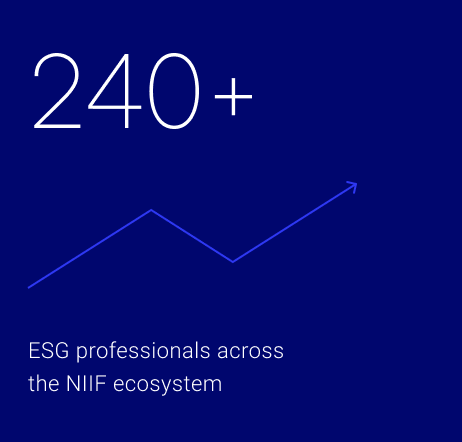

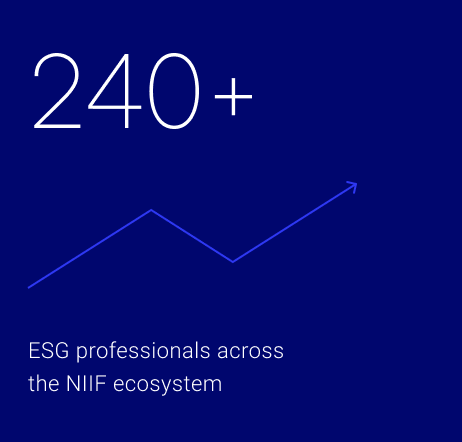

Every business decision we make is in line with our purpose to benefit our stakeholders by assessing inherent risks and opportunities. We lead the way in adoption of best-in-class environmental, social and governance (ESG) standards that create a multiplier effect through our funds & portfolio companies. This is a key step towards consciously building a responsible investing business ecosystem.

We believe ESG integration is crucial to long term returns. Our ESG systems follow precautionary measures with the aim to mitigate risks & minimise impact on the communities in & around the areas of our investments.

CIN: U74900DL2015PLC287894

3rd Floor, Hindustan Times House, 18-20, Kasturba Gandhi Marg New Delhi – 110001

UTI Tower, GN Block, 4th Floor, BKC, Mumbai – 400 051

CIN: U74900DL2015PLC287894

3rd Floor, Hindustan Times House, 18-20, Kasturba Gandhi Marg New Delhi – 110001

UTI Tower, GN Block, 4th Floor, BKC, Mumbai – 400 051

ALL RIGHTS RESERVED © 2025 NIIF

DESIGNED BY LUCID LEGAL DISCLAIMER | PRIVACY COOKIE POLICY | STATUTORY INFORMATION

DESIGNED BY LUCID

Learn More

Learn More