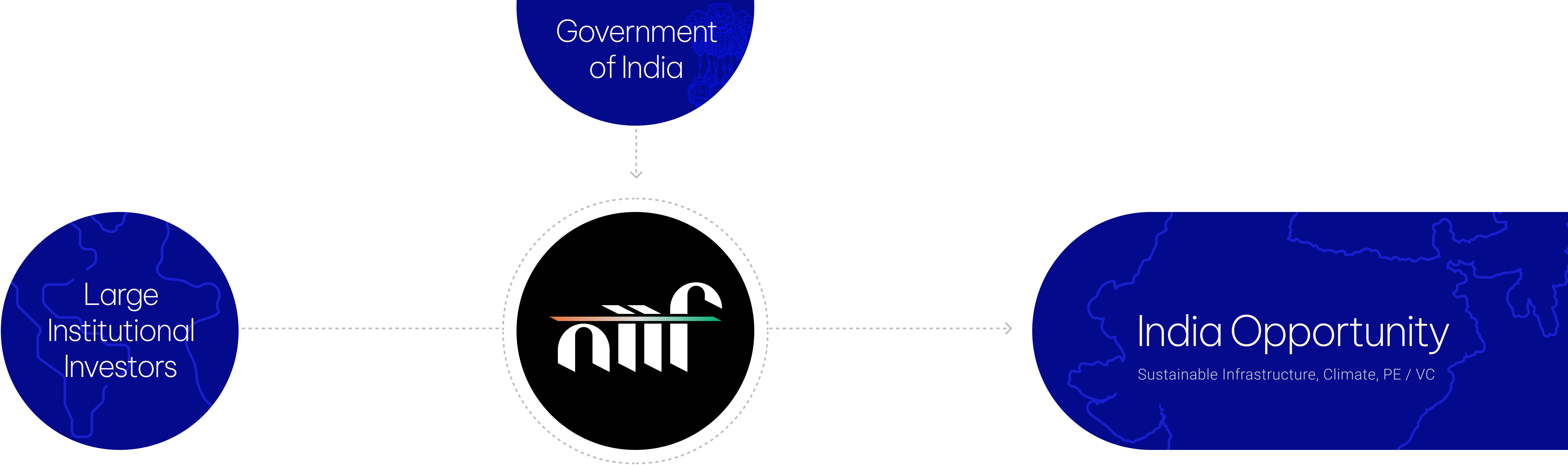

NIIF bridges global capital & the India opportunity

Assets under management across our funds

Direct & indirect investments

Employed across NIIF ecosystem

The largest India-focused infrastructure fund

Investing in high-quality infrastructure businesses & assets to drive India’s infrastructure growth story

NIIF’s Private Equity platform offers a gateway for global institutional investors to participate in India’s dynamic growth story.

NIIF’s India-Japan Fund invests in sectors that focus on environmental preservation and promotes business collaboration between Japanese and Indian companies.

The fund’s strategy is to invest in high quality businesses & assets across different core infrastructure sectors.

The fund’s strategy is to invest in high quality businesses & assets across different core infrastructure sectors.

The fund’s strategy is to invest in high quality businesses & assets across different core infrastructure sectors.

The fund’s strategy is to invest in high quality businesses & assets across different core infrastructure sectors.

Holistic provider of solutions to our LPs & Indian companies through equity & structured debt

CIN: U74900DL2015PLC287894

3rd Floor, Hindustan Times House, 18-20, Kasturba Gandhi Marg New Delhi – 110001

UTI Tower, GN Block, 4th Floor, BKC, Mumbai – 400 051

CIN: U74900DL2015PLC287894

3rd Floor, Hindustan Times House, 18-20, Kasturba Gandhi Marg New Delhi – 110001

UTI Tower, GN Block, 4th Floor, BKC, Mumbai – 400 051

ALL RIGHTS RESERVED © 2025 NIIF

DESIGNED BY LUCID LEGAL DISCLAIMER | PRIVACY COOKIE POLICY | STATUTORY INFORMATION

DESIGNED BY LUCID

Learn More

Learn More